Applying AI to Extract Trade Patterns from Early Merchant Ledger Books

Applying AI to Extract Trade Patterns from Early Merchant Ledger Books

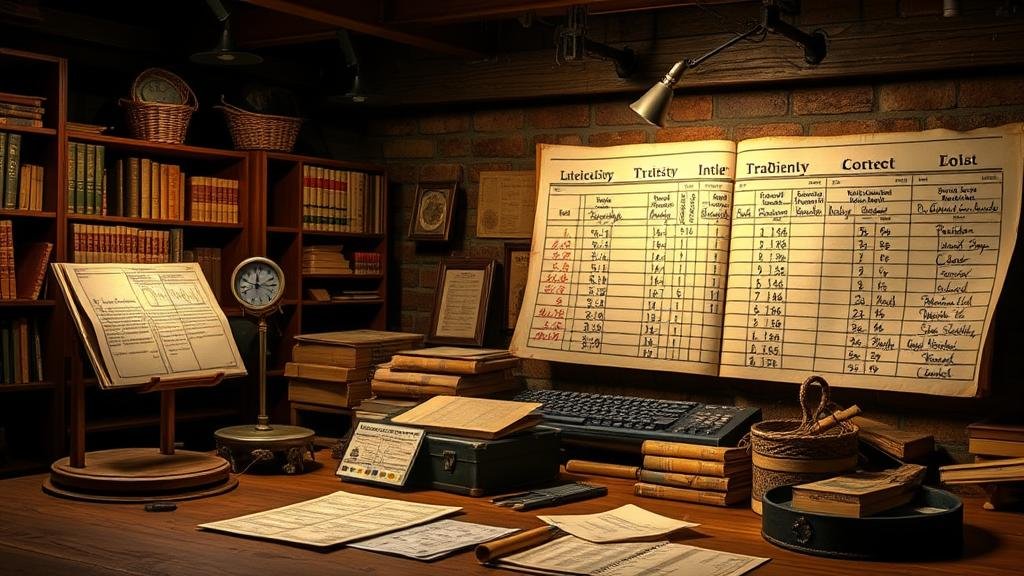

In recent years, the integration of Artificial Intelligence (AI) in historical research has fundamentally transformed how scholars analyze historical economic data. In particular, early merchant ledger books, which document transactions from various historical epochs, offer profound insights into trade patterns, economic behaviors, and social dynamics. By employing AI technologies, researchers can automate the extraction and analysis of these complex datasets, leading to richer historical narratives and deeper understandings of past economic systems.

Historical Context of Merchant Ledger Books

Merchant ledger books, which date back to as early as the 13th century, contain records of commerce, trade agreements, and financial transactions. e documents typically include details such as dates, names of merchants, types of goods traded, quantities, and monetary values. For example, the ledger of Venetian merchants from the late Middle Ages provides a prolific repository of trade data, underscoring the economic vitality of Mediterranean commerce.

According to P. K. Kallio (2019), ledger books are not merely financial records; they are vital historical documents that reflect the socio-economic conditions of their times, illustrating the network of trade routes and the interactions between diverse cultures. But, extracting actionable insights from these extensive records presents considerable challenges due to their archaic language, varied formats, and handwritten scripts.

The Role of AI in Data Extraction

AI technologies, particularly Natural Language Processing (NLP) and Optical Character Recognition (OCR), have emerged as effective tools for transforming raw textual data from historical documents into structured, analyzable formats.

- NLP Applications: NLP algorithms can be trained to parse and understand the language used in merchant ledgers, allowing researchers to systematically identify relevant economic entities and relationships.

- OCR Technologies: OCR converts scanned handwritten or printed text into machine-readable data, facilitating the digitization of extensive ledger collections. For example, the U.S. National Archives has employed OCR to digitize historical documents for better accessibility.

The process begins with scanning the physical ledger books, followed by image preprocessing to enhance text clarity. This image data is then inputted into OCR software, which extracts text content. Then, NLP models analyze this text to identify patterns, relationships, and trends in the data.

Case Studies of AI Useation

Several projects internationally have illustrated the successful application of AI tools in extracting trade patterns from historic merchant ledgers. One notable case is the Transcribe Bentham project at University College London, which utilized crowd-sourced transcription combined with AI to digitize and analyze the writings of philosopher Jeremy Bentham. Although the focus was primarily on Benthams manuscripts, the methodologies developed here can be directly applicable to ledger analysis.

Another relevant project is the HIST&RE initiative in Europe, which has explored the use of machine learning algorithms to extract economic indicators from ledgers dating back to the 16th century. Their findings indicated significant trends in trade fluctuations correlating with key historical events, such as the establishment of the East India Company.

Challenges and Limitations

While the application of AI offers substantial advantages, several challenges persist. accuracy of OCR can be affected by the quality of the original documents, especially if they have deteriorated over time. Plus, AI models require substantial training data, which may not always be uniformly available or annotated across different ledger sources.

Also, ethical considerations surrounding data privacy and model bias must be addressed. For example, historical data analysis may inadvertently reinforce contemporary biases if not approached with caution. Researchers must ensure that AI-driven conclusions are validated against historical context to avoid misinterpretation.

Future Directions and Conclusion

The future of applying AI in examining early merchant ledger books appears promising. Continued advancements in machine learning and AI will allow for better accuracy in data extraction, expanding the scope of research possibilities. Also, interdisciplinary collaboration between historians, data scientists, and AI specialists will be crucial in optimizing these technologies for historical analysis.

To wrap up, the convergence of AI and historical economic analysis provides a powerful avenue for extracting trade patterns from early merchant ledger books. By overcoming existing challenges and harnessing the potential of AI, researchers can gain unparalleled insights into the economic landscapes of the past, ultimately enriching our understanding of historical commerce and its implications for contemporary economic theories.